Explain Any Possible Differences Between Accounting for an Account Recievable

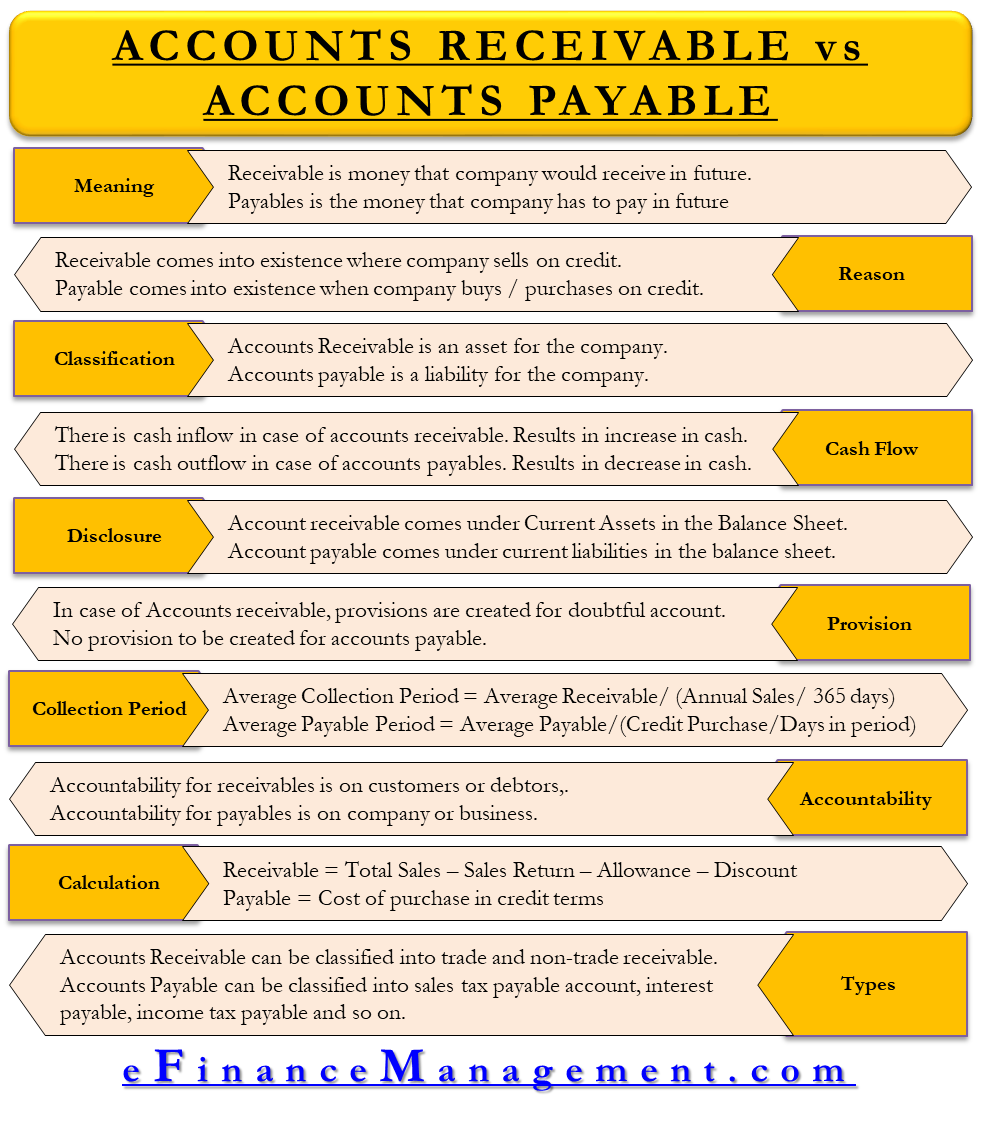

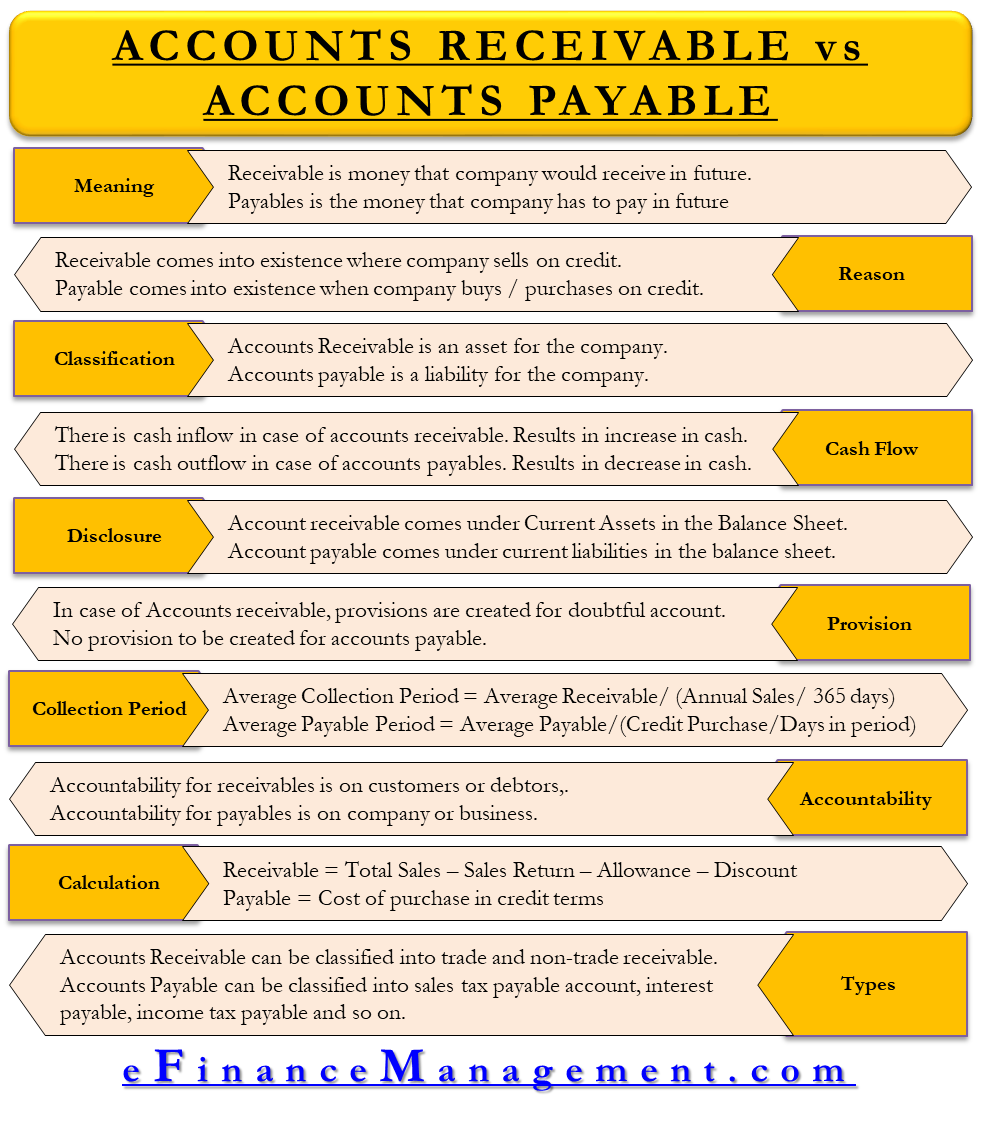

However under accrual accounting you record revenue at the same time that you record an account receivable. The key difference between accounts payable and accounts receivable is that accounts payable tracks money you owe and accounts receivable tracks money others owe you.

Accounts Receivable Vs Accounts Payable All You Need To Know

1 profit and 2 assets.

. Explain the LIFO retail inventory method. Allowing the buyer to defer payment Briefly explain the difference between the from ACC 301 at Pace University. The main difference between accounts payable and accounts receivable is who owes money.

Explain the Importance of Accounting and Distinguish between Financial and Managerial Accounting. Explain the difference between cash and accrual basis methods of accounting and how each method would produce different profit or. Accounts receivable is an asset account not a revenue account.

These are two principal types of receivables for a company and. Is any special accounting treatment required for the assigning of accounts receivable in general as collateral for debt. Explain any possible differences between accounting for an account receivable factored with recourse compared with one factored without recourse.

2019 and received only 500 for its value. In accounting confusion sometimes arises when working between accounts payable vs accounts receivable. The accounts receivable aging report itemizes all receivables in the accounting system so its total should match the ending balance in the accounts receivable general ledger account.

Accounts receivable AR is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Explain any possible differences between accounting for an account receivable factored with recourse compared with one factored without recourse. The difference between the book value and the fair value of proceeds received is recognized as a gain or a loss.

When the money owed by a party to another party called creditor then accounts payable is signed. If there is a difference between the report total and the general ledger balance the difference. When the money owed to a party by another party called debtor then accounts receivable is signed.

Accounts payable are concerned with money you owe vendors and suppliers for business expenses. The accounting staff should reconcile the two as part of the period-end closing process. Explain any possible differences between accounting for account receivable factored with recourse compared with one factored without recourse The buyer assumes the risk of uncollectibility when accounts receivable are sold without recourse.

Q7-13 The accounting treatment of receivables factored with or without recourse depends on whether the sale criteria are met. Key Difference Accounts Receivable vs Notes Receivable. Notes receivable and accounts receivable both show up on your balance sheet as assets.

The two types of accounts are very similar in the way they are recorded but it is important to differentiate between accounts payable vs accounts receivable because one of them is an asset account and the other is a liability account. The key difference between accounts receivable and notes receivable is that accounts receivable is the funds owed by the customers whereas notes receivable is a written promise by a supplier agreeing to pay a sum of money in the future. It is a short duration loan of a business for goods and services purchased on account.

Notes receivable does too but this category only includes debts that have a promissory note attached. In other words accounts payable is a current liability and accounts receivable is a current asset. How to Document the Differences Any items that are already recorded in the companys general ledger accounts but have not yet appeared on the bank statement outstanding checks deposits in transit will be noted as an adjustment to the balance per bank statement.

Q 7-13 Explain any possible differences between accounting for an account receivable factored with recourse compared with one factored without recourse. Accounts receivables are listed on the balance sheet as a. In addition note disclosure may be required.

GAAP requires more disaggreagtion of accounts and note receivable in the balance sheet or notes. Identify two advantages of dollar-value LIFO compared with unit LIFO. Explain any possible differences between accounting for an account receivable factored with recourse compared with one factored without recourse.

Students also viewed these Accounting questions Accounting for the transfer of receivables with recourse has been problematic. Explain any possible differences between accounting for an account receivable factored with recourse compared with one factored without recourse. The difference between 2200 and 500 of 1700 is the factoring expense.

For the example above youd make the following entry in your books the moment you invoice Keiths Furniture. 57 Explain How Notes Receivable and Accounts Receivable Differ. If they are not met the factoring is accounted for as a loan.

Explain any possible differences between accounting for an account receivable factored with recourse compared with one factored without recourse. For example companies need to separately disclose accounts receivable from customers from related parties and from others. If the business was to apply the correct measurement basis determine the effect on.

Accounts receivable factored without recourse are accounted for as the sale of an asset. Business Accounting QA Library explain how the accounts receivable and inventory should be valued on the financial statements. Accounts receivable tracks money youre owed but havent received yet.

In a factoring arrangement without recourse the buyer assumes the risk of uncollectibility. Debts entered as notes receivable are usually paid back over a longer period.

Difference Between Accounts Payable And Accounts Receivable Compare The Difference Between Similar Terms

Should Accounts Receivable Be Considered An Asset Billtrust

Difference Between Accounts Receivable And Payable Management

Comments

Post a Comment